Stockholders Equity (Rate Of Return On Common Stock Equity, C/S Shareholder Profitability) - YouTube

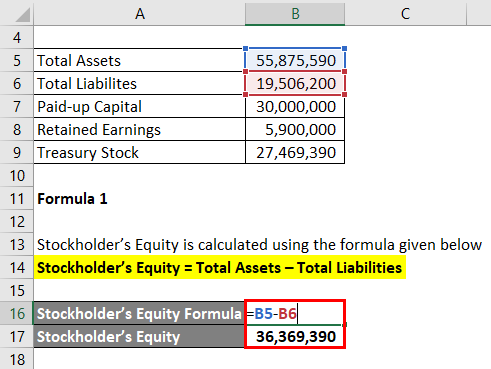

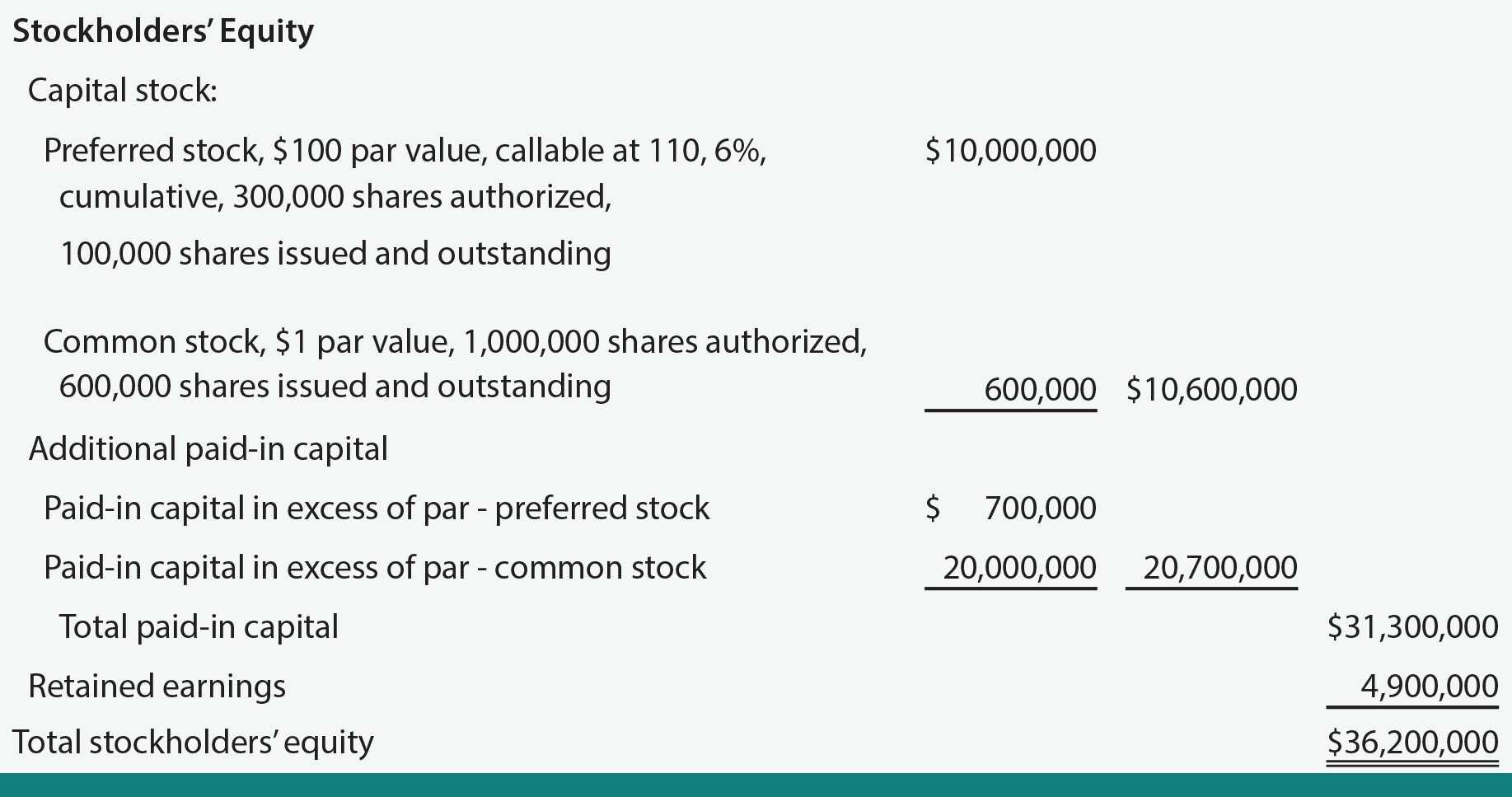

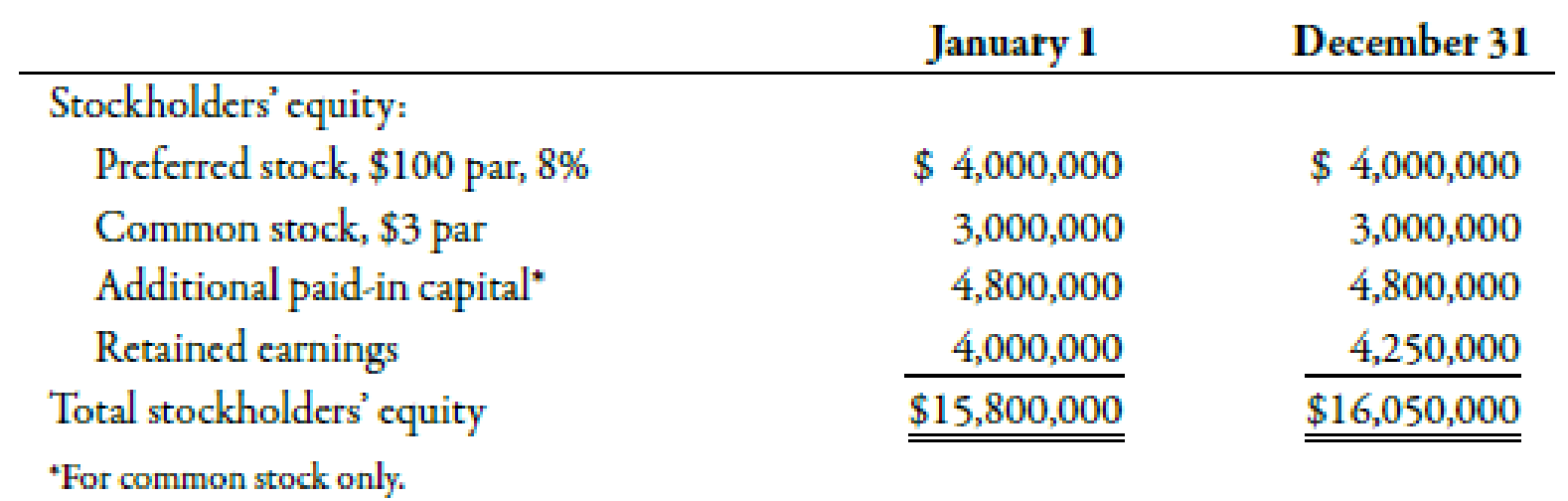

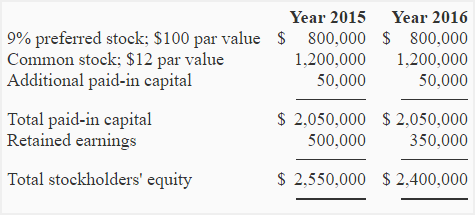

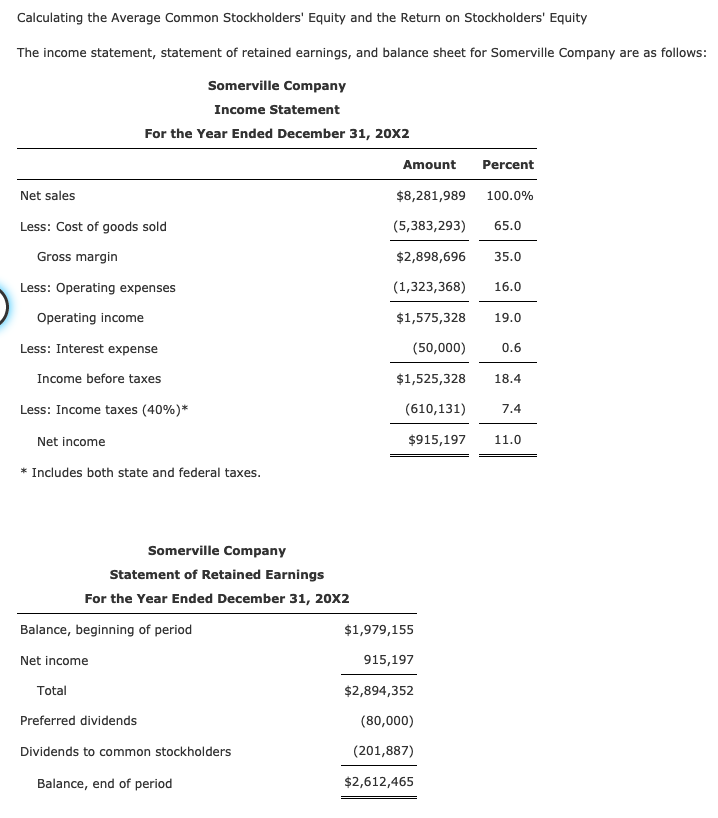

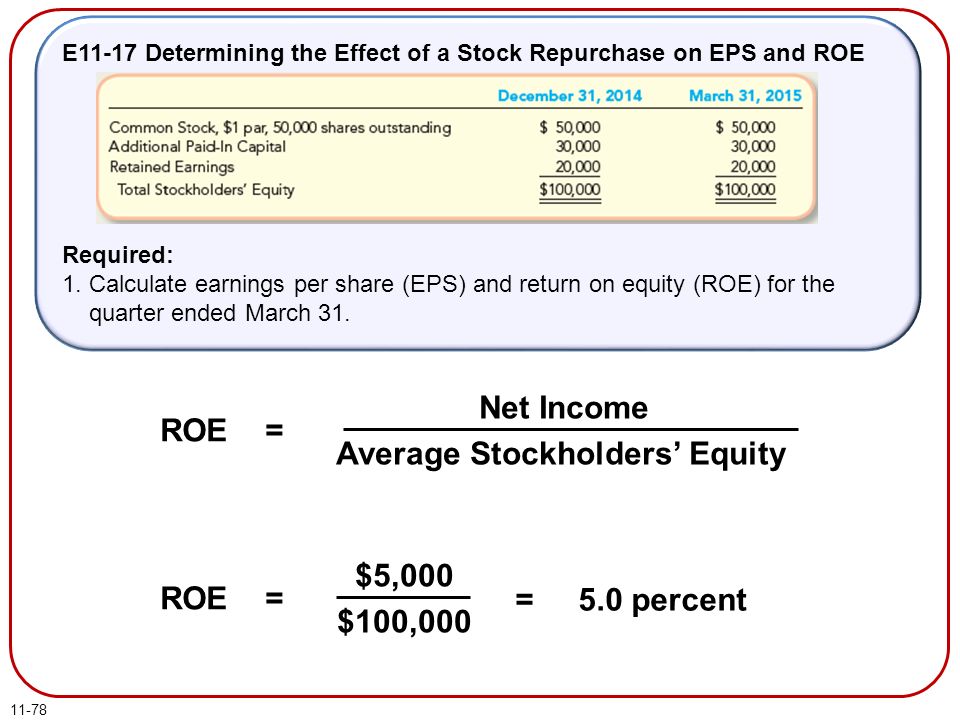

Rebert Inc. showed the following balances for last year: Rebert's net income for last year was $3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders'

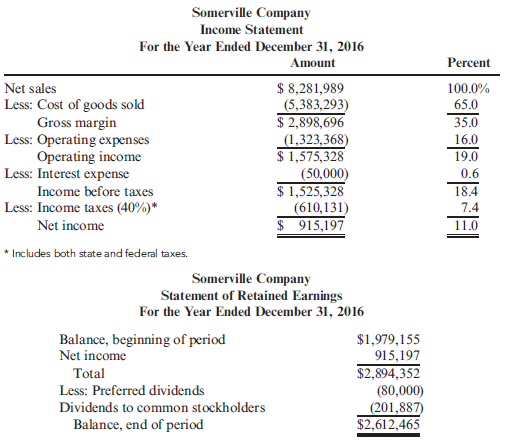

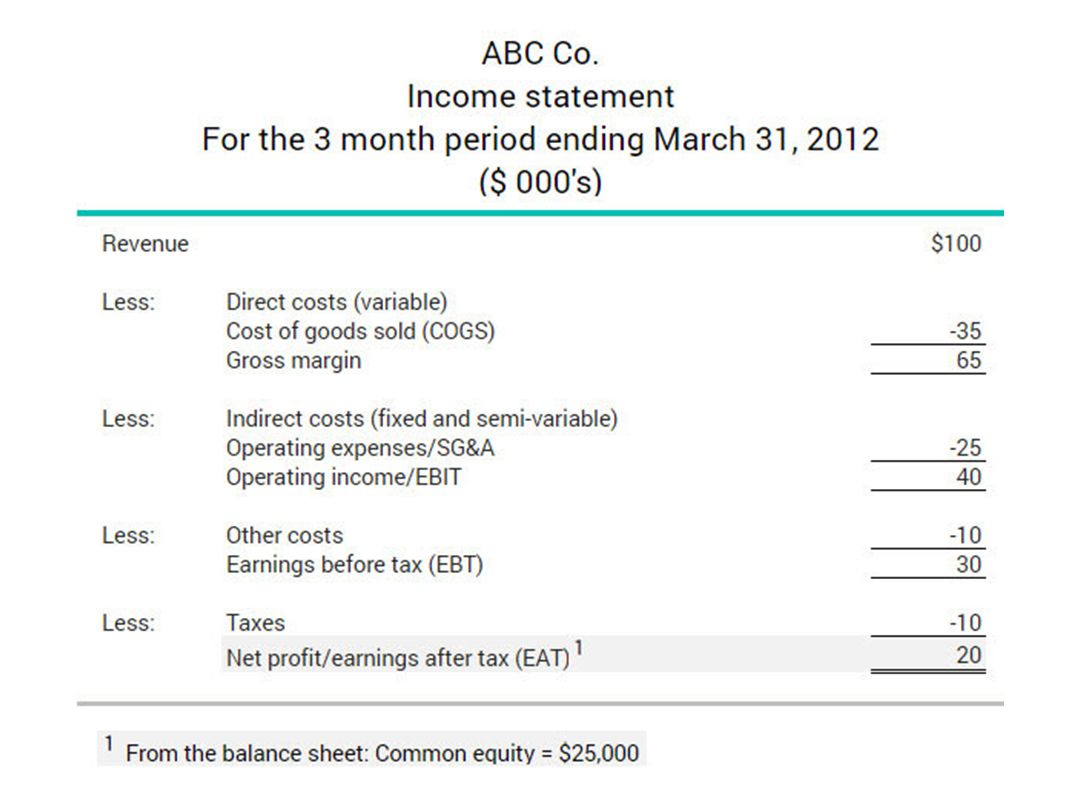

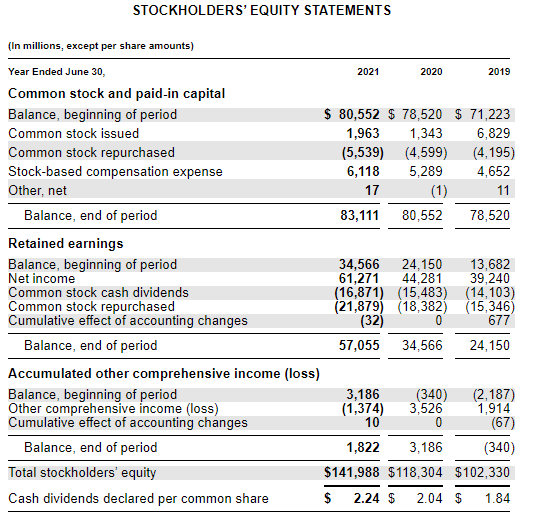

Return on common stockholders' equity ratio - explanation, formula, example and interpretation | Accounting For Management

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)