What is the duration of a zero-coupon bond that has eight years? What is the duration if the maturity increases to 10 years? - Quora

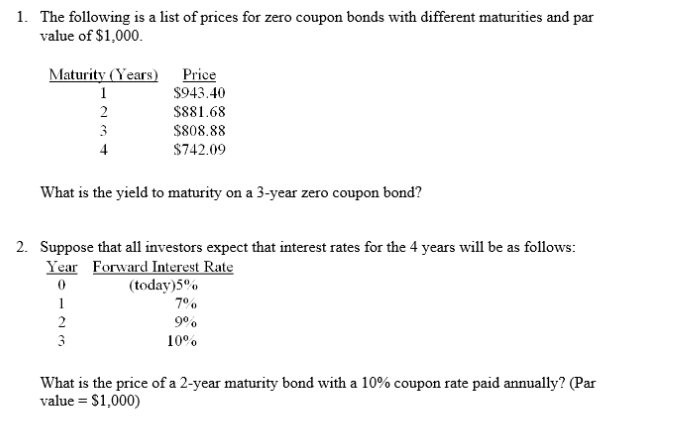

Chapter 2 Pricing of Bonds. Time Value of Money (TVM) The price of any security equals the PV of the security's expected cash flows. So, to price a bond. - ppt download

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)