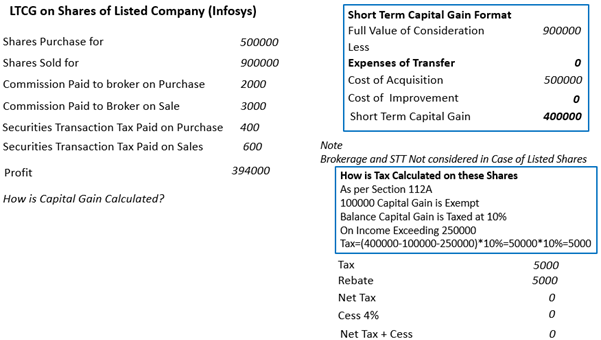

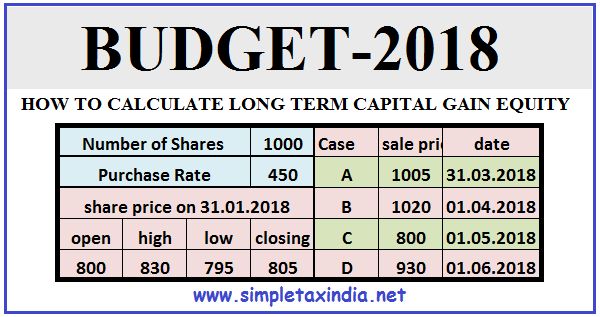

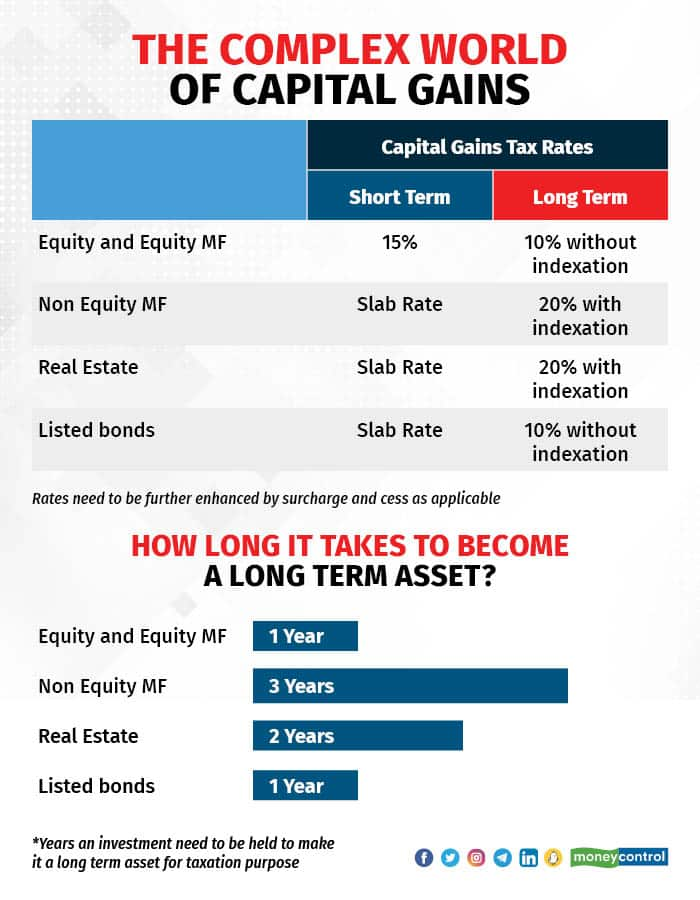

Initial public offerings, bonus and rights issues will be eligible for concessional rate of 10% long-term capital gains (LTCG) tax even if the Securities Transaction Tax (STT) has not been paid earlier.

Mutual Funds Capital Gains Taxation Rules FY 2018-19 (AY 2019-20) | Capital Gains Tax Rates Chart for NRIs. | Mutuals funds, Capital gain, Fund

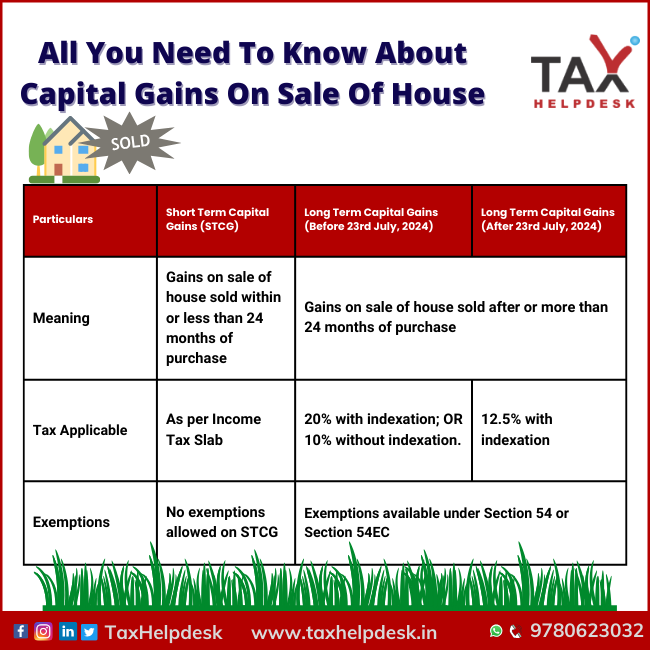

Budget 2023 Expectations: Shorter holding period for non-equity funds, hike in equity LTCG limit to Rs 2 lakh